Some time ago, Yellen visited China, is said to shoulder a lot of “tasks”, foreign media to help her sum up one of them: “to convince Chinese officials that the United States in the name of national security to prevent China from obtaining sensitive technology such as semiconductors and a series of measures are not intended to harm the Chinese economy.”

It has been 2023, the United States has launched a ban on the Chinese chip industry has been no less than a dozen rounds, the entity list of mainland enterprises and individuals more than 2,000, the opposite can also make up such a grand reason, touching, it is simply “he really, I cry to death.”

Perhaps Americans themselves could not bear to see it, which was soon hit by another article in the New York Times.

Four days after Yellen left China, Alex Palmer, a well-known China reporter in the foreign media circle, published An article on the NYT describing the US chip blockade, which was directly written in the title: This is An Act of War.

Alex Palmer, a Harvard graduate and the first Yanjing Scholar at Peking University, has long covered China, including Xu Xiang, fentanyl and TikTok, and is an old acquaintance who has hurt the feelings of the Chinese people. But he did get the Americans to tell him the truth about the chip.

In the article, one respondent bluntly stated that “not only will we not allow China to make any progress in technology, we will actively reverse their current level of technology” and that the chip ban is “essentially about eradicating China’s entire advanced technology ecosystem.”

The Americans took the word “eradicate,” which shares the meaning of “exterminate” and “uprooted,” and is often referenced in front of the smallpox virus or Mexican drug cartels. Now, the object of the word is China’s high-tech industry. If these measures succeed, they could affect China’s progress for a generation, the authors predict.

Anyone wanting to grasp the extent of the war will need only to chew the word eradicate repeatedly.

01

Escalating war

The law of competition and the law of war are in fact two completely different things.

Business competition is a competition within a legal framework, but war is not the same, the opponent has almost no regard for any rules and restrictions, will do anything to achieve their own strategic objectives. Especially in the field of chips, the United States can even constantly change the rules – you adapt to one set, it immediately replaced a new set to deal with you.

For example, in 2018, the US Department of Commerce sanctioned Fujian Jinhua by way of “entity list”, which directly led to the latter’s suspension of production (which has now resumed work); In 2019, Huawei was also included in the entity list, restricting American companies from providing products and services to it, such as EDA software and Google’s GMS.

After finding that these means could not completely “eliminate” Huawei, the United States changed the rules: from May 2020, it began to require all companies using American technology to supply Huawei, such as TSMC’s foundry, which directly led to the stagnation of Hisiculus and the sharp contraction of Huawei’s mobile phones, bringing more than 100 billion yuan of losses to China’s industrial chain every year.

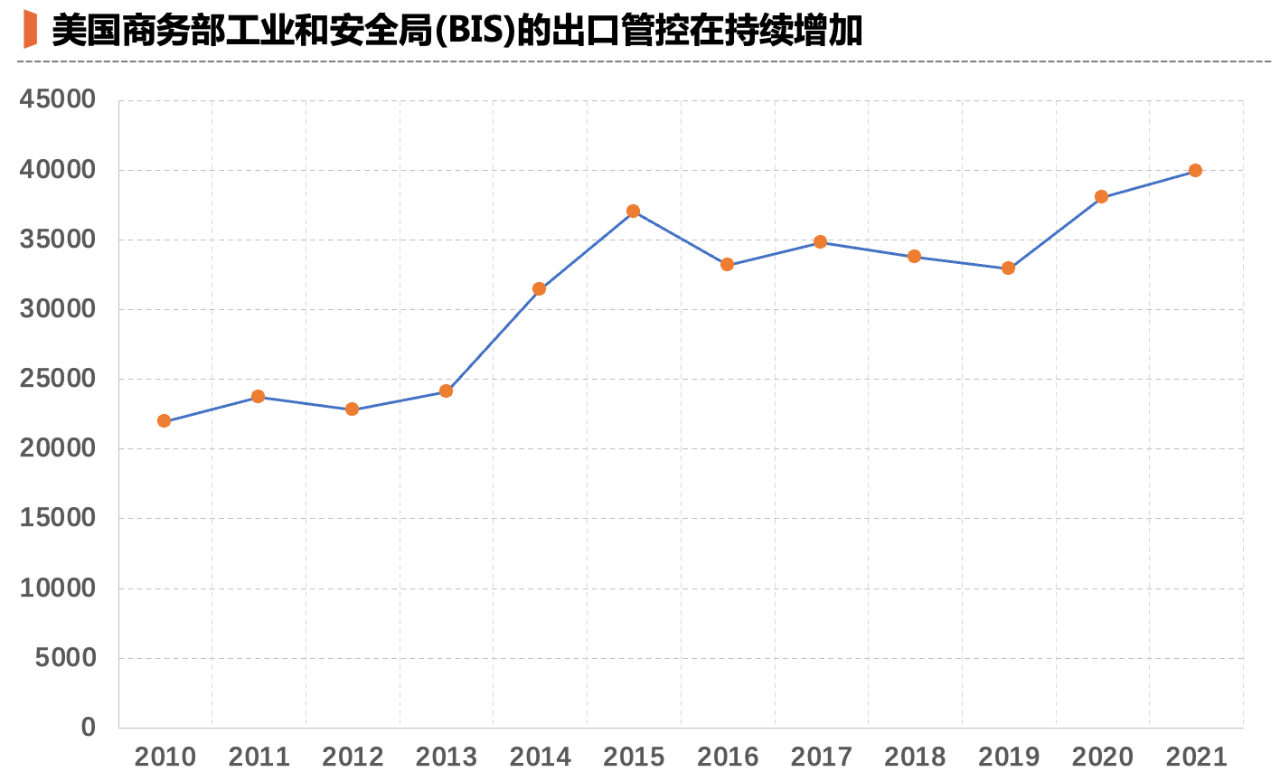

After that, the Biden administration increased the firepower target from “enterprise” to “industry”, and a large number of Chinese enterprises, universities and scientific research institutions were successively included in the ban list. On October 7, 2022, the U.S. Department of Commerce’s Bureau of Industry and Security (BIS) issued new export control regulations that almost directly set a “ceiling” on Chinese semiconductors:

Logic chips below 16nm or 14nm, NAND storage with 128 layers or more, DRAM integrated circuits with 18nm or less, etc. are restricted for export, and computing chips with computing power exceeding 4800TOPS and interconnection bandwidth exceeding 600GB/s are also restricted for supply, whether foundry or direct sales of products.

In the words of a Washington think tank: Trump is targeting businesses, while Biden is hitting industries.

When reading the Three-Body Problem novel, it is easy for ordinary readers to understand the Yang mo of Zhizi to lock up the Earth technology; But in reality, when many non-industry people look at the chip ban, they often have a perception: as long as you abide by the rules of the United States, you will not be targeted; When you’re targeted, it means you did something wrong.

This perception is normal, because many people still stay in the “competition” frame of mind. But in “war,” this perception may be an illusion. In recent years, many semiconductor executives have reflected that when an enterprise’s independent research and development begins to get involved in advanced fields (even just pre-research), it will encounter an invisible gas wall.

The research and development of high-end chips is based on a set of global technology supply chain, such as to make 5nm SoC chips, you need to buy cores from Arm, buy software from Candence or Synopsys, buy patents from Qualcomm, and coordinate production capacity with TSMC… As long as these actions are done, they will enter the field of vision of the BIS supervision of the US Department of Commerce.

One case is a chip company owned by a mobile phone manufacturer, which opened a research and development subsidiary in Taiwan to attract local talents to do consumer-grade chips, but soon encountered the “investigation” of relevant Taiwan departments. In desperation, the subsidiary was spun out of the mother as an independent supplier outside the body, but it had to be careful.

Eventually, the Taiwanese subsidiary was forced to shut down after a raid by Taiwanese “prosecutors” who raided and took away its servers (no violations were found). And a few months later, its parent company also simply took the initiative to dissolve – the top management found that under the changing ban, as long as it is a high-end chip project, there is a risk of “one-click zero.”

Indeed, when the unpredictable business meets the major shareholder who likes the moat of Maoxiang technology, the outcome is basically doomed.

This “one-click zero” ability is essentially the United States has turned the “global industrial division based on free trade” previously pursued into a weapon to attack the enemy. American scholars have come up with the term weaponized interdependence to sugarcoat this behavior.

After seeing these things clearly, many of the previously controversial things are unnecessary to discuss. For example, there is no point in lampooning Huawei for violating the ban on Iran, because it has been clearly stated that “Iran is just an excuse”; It is ludicrous to blame China for its industrial policy, given that the United States is spending $53 billion to subsidize chip manufacturing and promote reshoring.

Clausewitz once said, “War is the continuation of politics.” Same with the chip wars.

02

The blockade bites back

Some people will ask: the United States so “the whole country to fight”, there is no way to deal with it?

If you are looking for that kind of magic trick to break the enemy, it is not. Computer science itself was born in the United States, especially the integrated circuit industry, the other side to use the means of war to play the right to speak of the industrial chain, China can only take a longer time to conquer from upstream and downstream bit by bit, which is a long process.

However, it is not true to say that this “act of war” has no side effects and can be used for a long time. The biggest side effect of the US sector-wide blockade is this: it gives China the opportunity to rely on market mechanisms, rather than the sheer force of planning, to solve the problem.

This sentence may seem difficult to understand at first. We can first understand what is the power of pure planning, for example, in the semiconductor industry, there is a special project to support major technical research, called “very large scale integrated circuit manufacturing technology and complete process”, the industry is usually called 02 special, pure financial funds.

02 special many companies have taken, when the author was in the semiconductor investment, when the research company saw a lot of “02 special” left the prototype, after seeing the feeling of mixed, how to say? Many of the equipment piled in the warehouse is a gray hand, probably only when the leaders of the inspection will be moved out to polish.

Of course, the 02 special project did provide valuable funds for enterprises in the winter at that time, but on the other hand, the efficiency of the use of these funds is not high. Relying on financial subsidies alone (even if the subsidies are enterprises), I am afraid it is difficult to make technologies and products that can be put into the market. Anyone who has ever done research knows this.

Before the chip wars, China had many struggling equipment, materials and small chip companies that struggled to compete with their foreign counterparts, and companies like SMIC, JCET and even Huawei usually did not pay much attention to them, and it is easy to understand why: they would not use domestic products when they could buy more mature and cost-effective foreign products.

But the United States’ blockade of China’s chip industry has brought a rare opportunity to these companies.

In the case of blockade, domestic manufacturers that were previously ignored by fabs or sealed test plants were rushed to shelves, and a large number of equipment and materials were sent into the production line for verification. And the long drought and rain of the domestic small factories suddenly saw hope, no one dared to waste this precious opportunity, so they also worked tirelessly to improve products.

Although this is an internal cycle of marketization, a forced out of the marketization, but its efficiency is also more efficient than the pure planning force: one party iron heart to domestic replacement, one party desperately grasping the straws, and in the science and technology board rich effect inspired by the semiconductor upstream almost every vertical segment there are many companies in the volume.

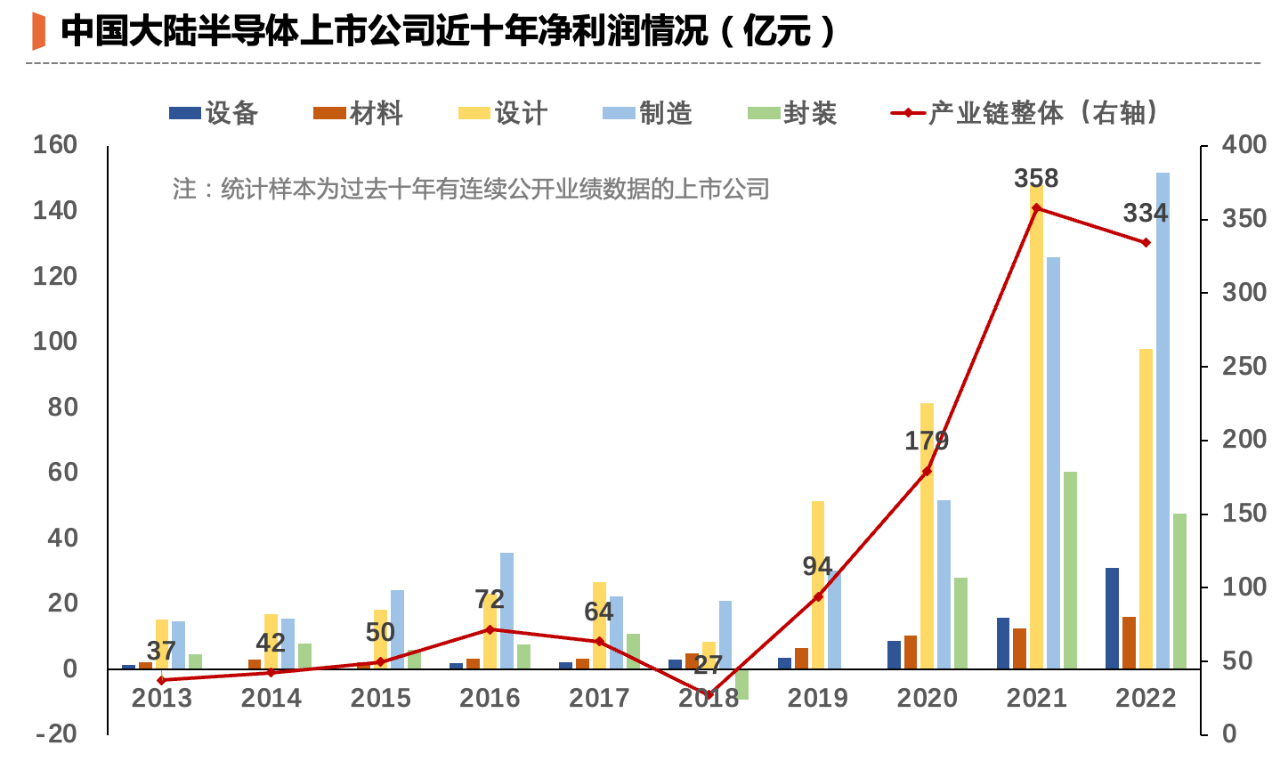

We have calculated the profit trend of China’s listed semiconductor companies in the past ten years (only companies with ten years of continuous performance are selected), and we will see a clear growth trend: 10 years ago, the total profit of these domestic companies was only more than 3 billion, and by 2022, their total profit exceeded 33.4 billion, nearly 10 times that of 10 years ago.

Post time: Oct-30-2023